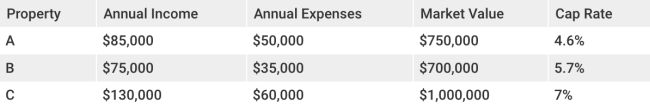

what is a good cap rate gas station

Also, the cap-rate assumes you're paying cash for a property and are not borrowing money. It does not take into consideration any costs associated with a mortgage such as interest or points. It doesn't account for any additional costs such as closing costs, broker's fees, or other expenses associated with acquiring the property.